SRI & ESG

A DEMANDING RESPONSIBLE APPROACH

EMERGENCE’s responsible approach is a concrete part of the action taken by Paris Europlace and the AFG in sustainable finance.

Based on the work of its ESG Committee and with the support of its delegated financial manager, EMERGENCE is raising awareness and actively supporting entrepreneurial asset management companies in their efforts to:

- Roll out their responsible investment policy

- Adopt best practices in terms of Environmental, Social and Governance (ESG) criteria

EMERGENCE provides:

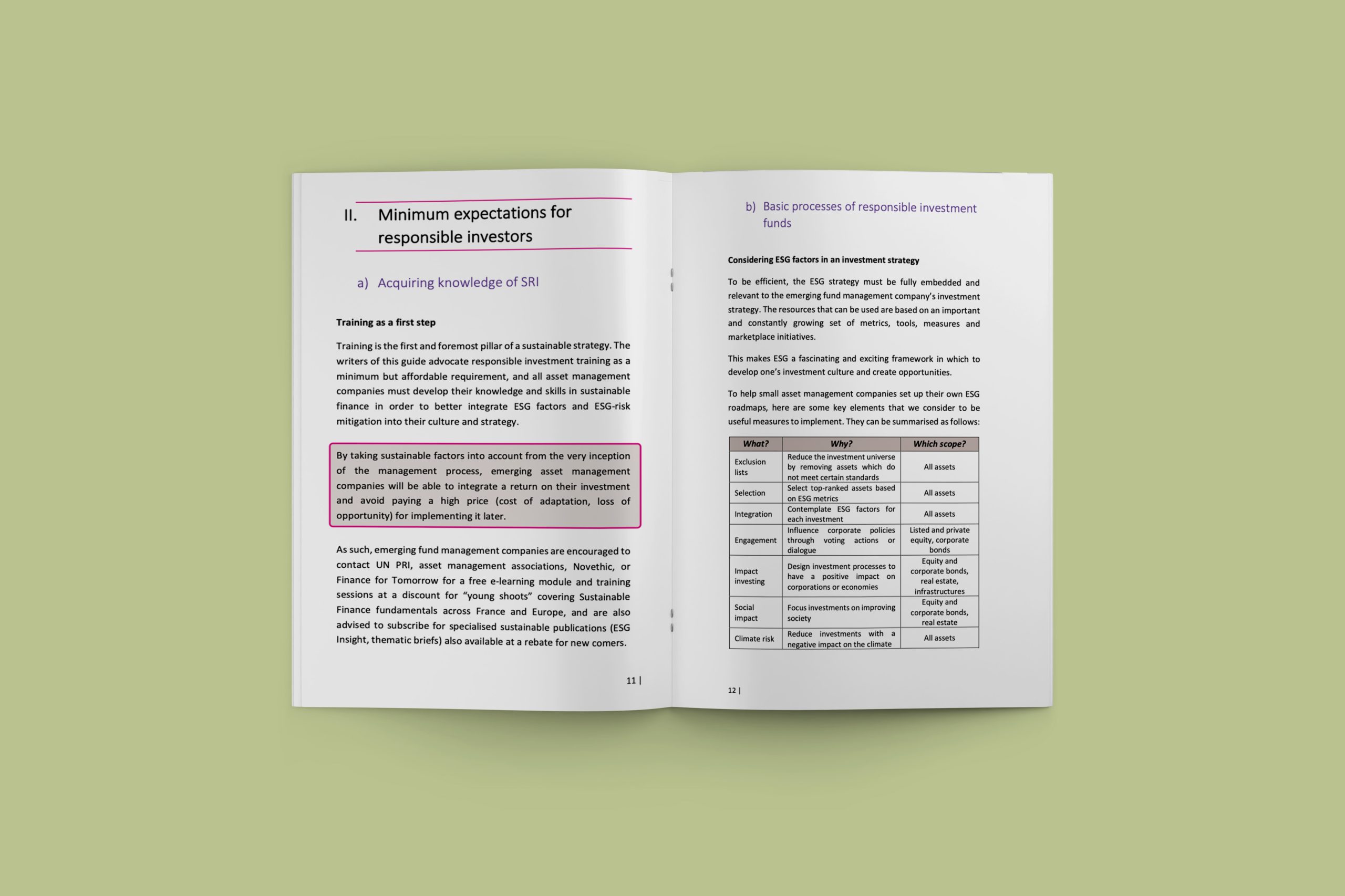

Its Practical Guide on Socially Responsible Investment (SRI), a compilation of the essential prerequisites for implementing an SRI policy consistent with the governance of each independent asset management company and with the approach of their investment strategies.

Its ESG Policy, which forms the basis of the ESG criteria adopted by EMERGENCE’s institutional investor shareholders in terms of responsible investment. It applies to any investment made for the SICAV’s equity sub-funds, starting with Emergence Europe.

EMERGENCE’s ESG policy is a unique achievement that brings together the shared expectations of institutional investors who are members of the SICAV. Using best practices, it sets an ambitious and flexible framework based on an incentive for progress, and aims to enable entrepreneurial fund managers to adapt to investors’ growing demands. It also reflects the desire to strengthen extra-financial status as an investment criterion within the SICAV and to make a concrete contribution to the transition to a sustainable economy

Karine LEYMARIE (MAIF) and Benoit DONNEN (NewAlpha AM) explain the benefits of EMERGENCE’s SRI measures for entrepreneurial asset management companies.